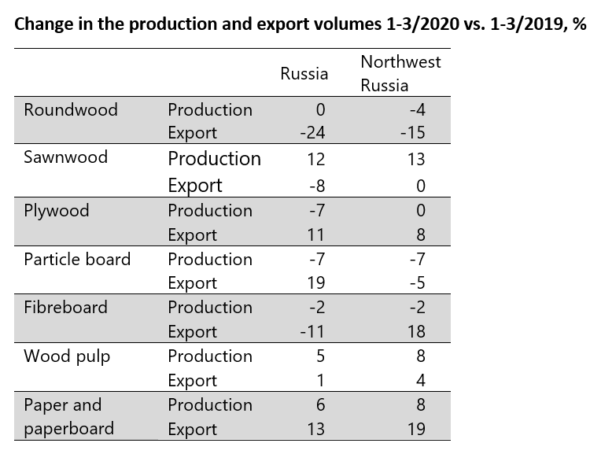

In January-March 2020, Russian roundwood production remained at the previous year’s level, while in Northwest Russia it decreased by four per cent. Roundwood exports decreased by almost a quarter compared to the previous year, with the largest decline to China (-34%). In addition to the corona epidemic, roundwood export was affected by the stricter phytosanitary requirements imposed by China.

During the first quarter, sawnwood production grew by more than ten per cent. At the level of Russia sawnwood export decreased by eight per cent, whereas in Northwest Russia export remained at the previous year’s level.

Production of plywood and particle board decreased by seven per cent, while there was less decrease in the production of fibreboard. However, exports of plywood increased by about 10 percent and particle board by almost 20 percent.

In the pulp and paper industry, both production and export volumes increased in January-March.

The corona pandemic will likely be reflected in forest industry production volumes more after April. Russia’s corona restrictions came into force on 30th March and the order for paid leave was extended until 8th May. The order was not applied to so-called socially important enterprises (sistemoobrazujuschiye), which are supported by the state through special measures. Of the forest industry, 35 companies are on the list, including for example the Kontupohja pulp and paper mill, Segezha Group, International Paper, Mondi SLPK, Lesozavod 25 sawmill, etc. There is less support available for the SME sector. As general support measures, it is planned to defer payment of tax for six months and to suspend bankruptcies. In order to support SMEs in the forestry sector, the Russian Forest Agency has proposed, among other things, the suspension of forest use fees, but this is not possible under current legislation.

On the effects of coronavirus on the forest sector in the Russian media:

Whatwood: The Russian forest sector has so far not been one of the biggest sufferers of the corona epidemic, but it is also affected by declining incomes and retail volumes. The first effect has been felt in the wood-based panel industry as purchases of building materials and furniture have declined. Wood-based panel manufacturers are reducing their production and even factory closures may have to be considered. For example, Sveza predicts a 20 percent decrease in plywood production in 2020. Production of particle board and MDF / HDF has been halted and production has been transferred to OSB as demand in the furniture industry has declined.

In the pulp and paper industry, the biggest impact of the corona epidemic will be strengthening decline in demand for graphic papers as a result of home quarantine and distance working. There has been no change in the demand for paperboard and the demand for tissue papers has increased. The operations of the pulp and paper mills have remained unchanged and were not affected by the “corona holiday”.

In wood harvesting, uncertainty is increasing and the expectations of harvesting companies are somewhat pessimistic. In the beginning of the year, the mills bought up their wood stocks and especially the competition for spruce pulpwood was tight. From April onwards, wood purchase typically decreases when the winter harvest ends and the season of frost-damaged roads begins. Correspondingly, wood prices are falling. The situation is not expected to improve rapidly, even when restrictions on the corona epidemic are removed.

Segezha Group, Nikolay Ivanov: China’s domestic sawnwood consumption has recovered and, as a result, order volumes and prices have increased. In contrast, demand for sawnwood used for further processing and further export has not recovered in China. In other markets, the situation is difficult. There is no demand for packaging, paper and plywood used in construction products once construction has stopped. A similar situation exists in the automotive and furniture industries, which are the main users of plywood. In Europe, the outlook is weak due to accumulating stocks, so the company is targeting forest product exports to alternative markets in the APEC countries, the Middle East, Latin America, India and, of course, “healed” China. Increased logistics costs are causing problems for Russian export companies. There is a shortage of containers and the rouble-denominated price of freight has more than doubled.

Syktyvkar Tissue Group, Alexander Kagan: As demand for hygiene products grows, production will increase in 2020. Problems are caused by the rising dollar rate, which has led to significant increases in the prices of imported spare parts, pulp, chemicals and other materials. In addition, the costs associated with protecting against the coronavirus have increased the cost price of products and decreased profitability. The weak rouble rate can lead to a shortage of the most important raw material, recovered paper, as its exports to the European market become more attractive. The pulp and paper industry considers that the Russian government should ban the export of recovered paper altogether.

Sveza, Vitaly Demidenko: Declining economic activity reduces demand for forest industry products and also for plywood. Demand is expected to recover in each region as restrictions are removed. In China and South Korea, demand for wood products has already recovered, and in Europe the situation is expected to start improving at the turn of May-June. In North America, market demand has weakened and orders have been postponed. Domestic demand in Russia has also decreased as construction has declined. The company is prepared for optimization and reduction of costs.

Ilim Timber, Svyatoslav Bychkov: The priority is to maintain market shares during the crisis, i.e. to maintain export volumes and steady deliveries to partners in China and Europe. The main effects of the corona pandemic are declining global demand, disruption of transport chains and tight competition between producers.

SevLesPil, Alexander Konyukhov: Production of sawnwood will be reduced compared to last year, the number of shifts has already been cut. As a result of the warm winter, wood harvesting volumes collapsed and not much is expected from summer fellings. If there is a shortage of raw material, production will be cut further. However, lay-offs are not planned. Particular attention must be paid to wood supply and the market. When China closed its borders, we shifted the focus of deliveries to Arab countries and Europe. However, the European market began to close before the situation in China recovered. The domestic demand for sawnwood is weak.

Cherepovetsles, Valery Pisarev: Sawnwood production will not decline this year, the company believes in the market. The production capacity of the sawmill is currently in full use. An increase in production volumes would require investment in equipment that is not possible. Coronavirus pandemic slows down the development plans. Exports to the European market have halved, and in Egypt and the Arab countries, negotiations have stalled due to distance work. In addition, the reduced wood harvesting volumes caused by the warm winter have an impact. In terms of wood harvesting, this year is critical for the forest industry when no one has wood stocks. For companies operating in export markets, the high exchange rate of the dollar and the euro is a great advantage.

Vologodskiye lesopromyshlenniki, Alexandra Aleksina: As a result of the closure of Europe’s borders, it is likely that the focus of sawnwood sales will shift to China and Egypt, leading to oversupply and falling prices.

Sari Karvinen, Luke

Statistics: Fedstat.ru, stat.customs.ru

Sources: Lesnaya Industriya № 4-5.2020, Russian Wood Resources Report No 11 (04-2020), Russian Timber Journal 03-2020, Government.ru, minpromtorg.gov.ru, base.garant.ru